The Trustee (Perpetual Succession) (Amendment) Act, 2021 (the “Amendment Act), which was signed into law on 23rd December, 2021 has made some amendments to the Trustees (Perpetual Succession) Act (Chapter 164 of the Laws of Kenya) (the Act”) in relation to registration of non-charitable trust and family trust in Kenya. Before this change, there was no comprehensive law that provided for registration of family trusts – through these were still being registered as simple trusts or as family companies. The Amendment Act was preceded by certain changes in tax laws through the Finance Act, 2021 which, inter alia, exempted transfers of property to a registered family trust from stamp duty and capital gain taxes.

As stated in the preamble to the Amendment Act, the new legal regime for registration of family trusts in aimed at promoting the usage of family trusts for purposes of preservation of inter-generational wealth.

In the new regime, like charitable and non-charitable trusts, family trusts will now be incorporated under the Act. Upon such incorporation, the family trust will:

- Become a body corporate by the name described in the certificate

- Have perpetual succession and a common seal

- Have power to hold and acquire property in its own name and by instruments under the common seal to convey, transfer, assign, charge and demise any movable or immovable property or any interest therein

- Have power to sue and be sued in its corporate name.

What is a Family Trust?

Under the Amendment Act, a ‘’family trust’’ is ‘’a trust, whether living or testamentary, partly charitable or non-charitable, that is registered or incorporated by any person or persons, whether jointly or as an individual, for the purpose of planning or managing their personal estate’

Generally speaking, a family trust is defined as a trust created for purposes of planning or managing one’s personal estate. In a nutshell, it is an estate planning tool. Under the new law, the family trusts should be made in contemplation of beneficiaries other than the settlor, and for the purpose of preserving or creating wealth for multiple generations. Moreover, a family trust should not be a trading entity. Therefore, where a trust intends to engage in trading or any businesses, this would only be possible through incorporation of separate trading companies which would be fully owned by the trust.

Deed of Settlement

The Amendment Act, also made provision for the settlement of property into family trusts by any person other than the settlor. This will encourage and ease the consolidation of wealth among families thereby promoting wealth preservation through generations. Settlement is a kind of transfer of property, predominantly immovable, by its owner. Nevertheless, invariably, in settlements, consideration would not be there directly as in the case of sales. For instance, a settlement can be made in favour of family members or even non relatives due to the love and affection that the executant/ owner of property had over the claimant. Thus ‘love and affection’ is considered as a consideration in settlement. Equally, a property can be settled in favour a trust also for religious or charitable purpose and the mental satisfaction is considered as the consideration.

Features of a Family Trust.

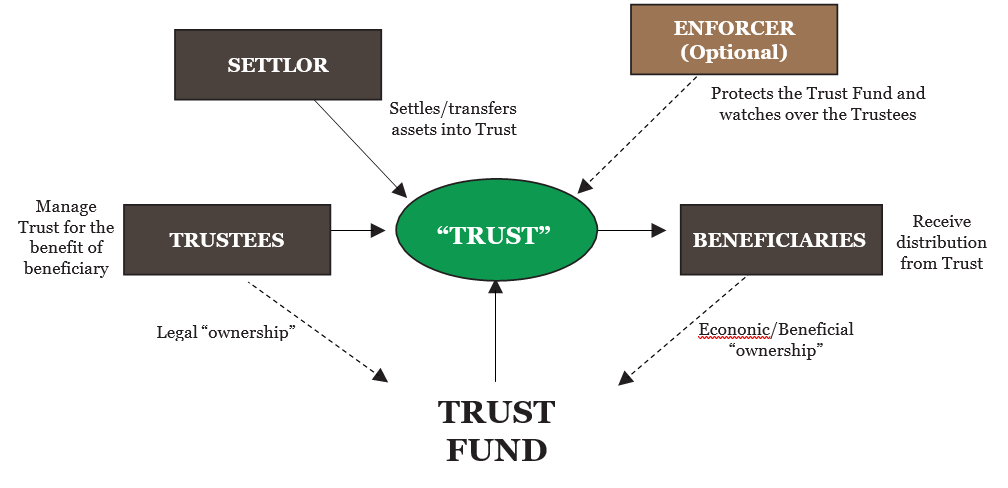

As indicated before, a family trust is a legal entity into which one can transfer assets to be managed or administered by trustees on behalf one or multiple family members. When you talk of trust, these main terms that should be understood are:

Trust deed/document: The legal agreement which establishes and set the terms and conditions under which the trustees will manage or administer the trust assets on behalf of the beneficiary or beneficiaries.

Grantor/settlor: The person who establishes or creates a trust.

Trustee(s): The person(s) who manage(s) the trust assets or the custodian of the The trustee can also be a body corporate usually known as corporate trustee.

Trust beneficiary or beneficiaries: The individuals or other persons that received benefits or receive income or assets from the trust.

Funding the trust: It is a process in which the grantor transfers the assets from his or her own personal names to that of the This will often involve changing the titles of assets from a person’s individual name to the name of the corporate trust. Examples are the transfer of a logbook of a car to the trust or a title deed to a property to the trust.

Who is an Enforcer?

The Amendment Act also introduced the concept of Enforcer, as a separate office that is distinct from that of trustees. The enforcer should be appointed by the settlor or, in his absence, the beneficiaries.

The office of the Enforcer is established to monitor the administration of the trust for the benefit of the beneficiaries. Whilst not a mandatory role, it would be prudent to provide for an enforcer in a trust deed. Under the Amendment Act, the enforcer is given an overarching / supervisory role over the trustees with mandate to:

- Enforce the terms of the trust;

- Inquire into the status of implementation of the trust;

- Require the trustee to remedy any breach of the terms of the trust

- Report any financial or other breaches by the trustee to the settlor or the beneficiaries and or to pursue legal action against the trustees for such breaches or other malfeasance

- Act in the place of trustees in any suit relating to the enforcement of the trust or breach of trust by the trustees

It should be underscored that under the Amendment Act, the Enforcer must be separate and distinct from the trustee(s). Therefore, the two offices cannot be occupied by the same person.

Registration of Family Trusts

Before the Amendment Act, the registration of trusts under the Act was vested in the office of the Cabinet Secretary and therefore riddled with uncertainty and administrative bureaucracy with incorporation of trusts being delayed for years.

The Most revolutionary part of this Amendment Act is the ease of the registration process. Under the amendment Act, the applications for incorporation of family trusts (as well as other forms of trusts) will be under the office of Principal Registrar of Documents and must be approved or rejected within sixty(60) days.

Tax Incentives for Family Trusts

As indicated before, the Amendment Act was preceded by amendments to the Finance Act, 2021 which introduced several tax incentives for family trusts. Under these changes, the tax exemptions shall apply in respect of:

- The income or principal sum of a registered family trust

- Capital gains relating to the transfer of title of immovable property to a family trust; and

- Capital gains accruing to an individual on the transfer of property, including investment shares, for the purpose of transferring the title or the proceeds into a registered family trust.

Further, with effect from 1st July, 2021, following the changes introduced by the said Finance Act to Section 11 of the Income Tax Act the following payout from a registered family trust will, inter alia, be exempt from family trust:

- Any amount that is paid out of the trust income on behalf of any beneficiary and is used exclusively for the purpose of education, medical treatment or early adulthood housing;

- Income paid to any beneficiary which is collectively below Kenya Shillings ten million (KShs. 10,000,000/=) in the year of income.

Advantages of Family Trust

The advantages of a family trust, inter alia, include:

- Tax Planning – Please refer to the aforesaid tax exemptions which will significantly reduce the total amount of tax paid on the trust income by the beneficiaries.

- Asset Protection – A family trust structure can protect your family’s wealth from creditors or in the event of divorce. Unless where trust is being used as creditors avoidance scheme, creditors of the beneficiaries cannot access trust This includes where a beneficiary becomes bankrupt.

- Avoidance of Probate – a trust structure can be used to avoid expensive and often continuous probate Unlike in cases of wills or settlements, third parties’ dependents cannot contest the provisions of a trust.

- Discretionary trusts – the family trust can be restructured as a discretionary trust in which case the trustees will decide when payouts are paid out, how frequently, and any other rules to prevent reckless spending by beneficiaries and generally for the preservation of the family

- Enforcer – The introduction of the independent office of enforcer (as aforesaid) will ensure that trustees of family act do not abuse their office or act ultra vires the terms of the trust deed. This will also reduce unwarranted litigation as the enforcer can also be given power to remove any offending trustees and to replace them with other trustees in consultation with the settlor or the beneficiaries.

How Gabael Trust Corporation Can Assist

Our Family Business and Estate Planning Unit should be happy to help you structure and register a family trust. Our tax lawyers will be involved in advising on the tax issues so that your trust is able to guarantee maximum tax benefits.